The other evening as I was walking out of my apartment I looked up and saw a projected advertisement on the side of my apartment building's wall. I was shocked. The advertisement was not the shocking part, it was the fact that someone paid money to do this advertisement on this particular wall. I mean advertisements are everywhere. On my dry cleaning hangers, coffee cup holders, in magazines, on TV, mobile apps, online, billboards, airplane TVs, subway cars, T-shirts, Netflix envelopes, taxis, newspapers, in the mail, on buses and cars, flyers, hot air blimps, on celebrities and athletes, on the radio, in bathroom stalls, literally anywhere you look and in thousands of different forms. So what? Well who is paying for all of these ads and how many dollars are there to go around? For 2009, Nielsen reported that there was $117 billion spent on US advertising. That is a lot of money, but for companies to continue keep the lights on they need to be getting a fair piece of that total pie and at the right price.

As I have gotten into the digital/new media space and being in NYC I feel like I hear about 3-4 new companies a day. Almost all them relying on the advertising business model. But with all these new companies coming up and all these other channels of advertising available, can demand meet all the supply that is available at a price that can be profitable for all the companies involved?

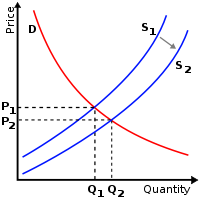

Below is an image of a normal supply demand chart. In economics this chart is trying to show the optimal price for a certain quantity of goods.

But as the supply of advertising space increases, with new companies and other avenues of advertising, (projected ads on buildings for example) prices for these ads will go down.

As prices go further and further down, revenues will decrease, profits will decrease and the overall ability for companies to stay afloat becomes more and more challenging. And this is how the tech bubble bursts. Right now every startup and tech company is projecting huge sales dollars based on current advertising prices. They continue to chase a story of how dollars are shifting towards digital or how demand has not yet met the supply available in the market. But will it ever? It is impossible to determine how much total available supply of advertising there is in a year, but we have all seen empty billboards, searches without advertisements, or plain coffee cup holders that just had an ad on it the day or week before.

So what does this mean? Well as more and more digital companies pop up and other forms of advertising appear, advertisers will have greater and greater power over publishers and the prices they pay. Just so publishers don't lose clients completely, they will drop prices, eventually leading to a unprofitable venture. If companies want to stay around they will need a few things. 1. they will need to come up with innovative advertising solutions that will drive real revenues and/or brand recognition for clients. 2. companies will need to be able to provide real insights and analytics on their users and how they are interacting with their product and the ads. 3. they will need a top notch sales force to be able to bring in clients because there is clearly a lot of competition out there.

Facebook, Twitter, Foursquare may have excellent products, with a lot of users, but if they and every other tech/media company wants to sustain the bursting of the bubble, they will need to be able to drive in real revenue, continuously, and not just rely on projected numbers based off of last years estimated sales growth, done by some analyst at JPMorgan. This can be done, it just requires some investment and innovative thinking.

I like to thank Seph from Proper Cloth and Steve Cheney from GroupMe for motivating me to start this blog. Thanks guys, I hope you like it...